Originally published in The Street

By Thomas Stoner Jr.

Everyone knows that the Paris climate agreement is meant to slow the use of fossil fuels and promote clean energy — but what does that mean for energy markets? For investors, is it as simple as going long on solar and short on coal?

Our team at Entelligent assessed the impact of the climate accord, and found some things you might expect as well as some surprises. As expected, renewable energy looks set to become more profitable but perhaps more surprisingly, coal could well remain a competitive fuel source for industrial production, if carbon dioxide (CO2) can be captured and stored. There is plenty margin for innovation and market adoption of new, cleaner technologies.

The agreement is a culmination of two decades of meetings that have finally brought what some are calling the end of the fossil fuel era. Representatives of nearly 200 governments at meetings in Paris committed to a legal agreement targeting net zero emissions in the second half of the century when the earth’s CO2 sinks (oceans, forests, etc.) are sufficient to absorb its CO2 sources (natural and human caused).

First, amid all the hype and hoopla, it’s worth noting that while countries have promised to manage carbon emissions they did not specify how, or sometimes even when, they will do so. That means modeling the impact on oil, coal and renewables companies from a market perspective is difficult, if not impossible, to undertake with precision. Nevertheless, it is possible to gauge the impact of the accord by employing some basic assumptions.

In all likelihood, most countries will try to reduce emissions through a mix of unwinding existing energy subsidies and employing a variety of incentives to promote renewable sources of energy such as wind and solar. Some countries will also place an outright tax or a price on carbon emissions.

In order to measure the impact of the Paris deal, we used a carbon tax or trading price for carbon of $50 per ton of CO2 — as a proxy to simulate the combined impact of various government actions to meet their reduction targets. Using that figure, we can estimate the impact on the global energy mix, supplier net revenues and costs, as well as investor returns.

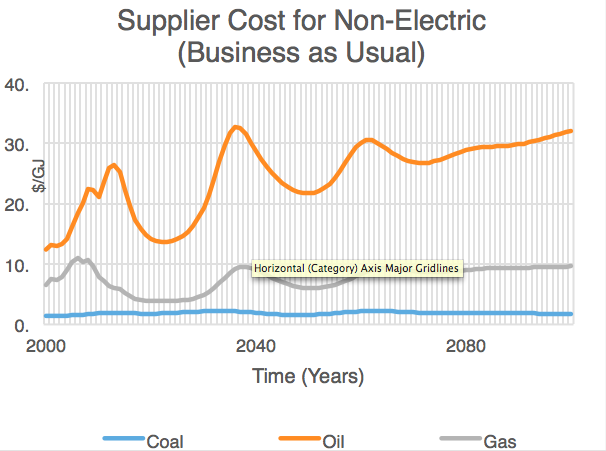

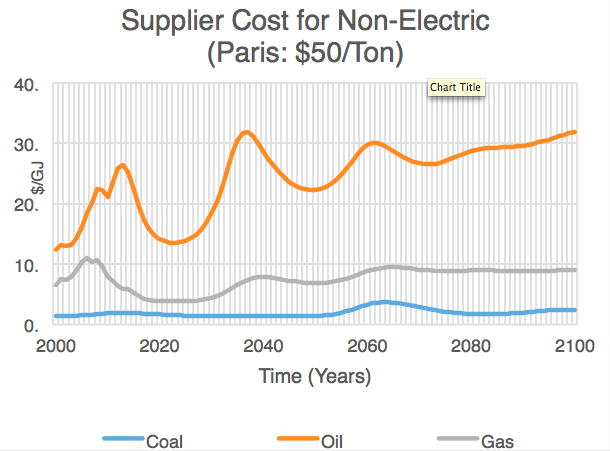

Using that blunt instrument of a $50 carbon tax allows us to examine two alternatives — a business-as-usual scenario where nothing much happens and another outcome where countries meet their promises.

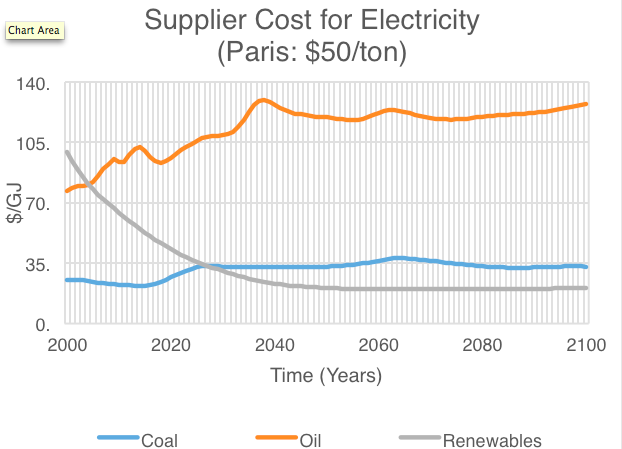

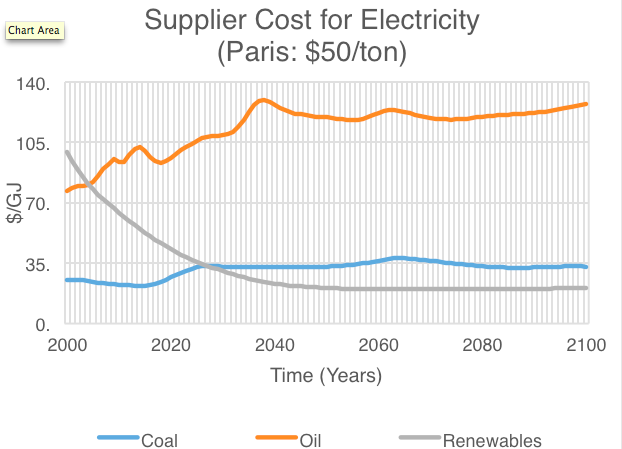

Even in a business-as-usual scenario, the forecasted supplier cost of electricity is expected to undergo dramatic change. Renewable energy costs are rapidly falling below the cost of oil and are set to converge with coal. Without the Paris climate accord scenario, coal remains competitive so long as its environmental costs are externalized.

However, once a $50 price on carbon is applied there is a major shift in competitiveness between coal and renewable energy. Renewable energy sources such as solar and wind emerge as clear winners by the mid-2020s.

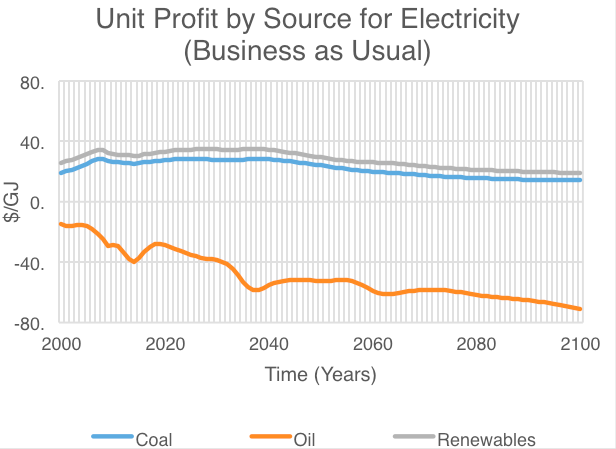

Looking at profitability in a business-as-usual scenario makes clear that generating electricity from oil is a losing proposition (obvious to anyone who has tried to power their home with a gas or diesel generator), whereas coal and renewable energy sources remain competitive, with renewables marginally more profitable.

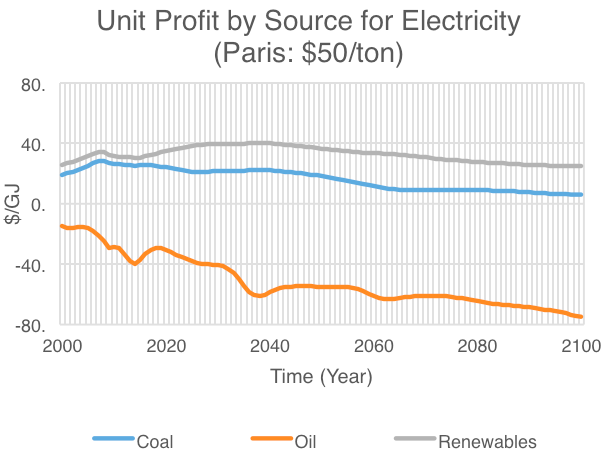

Looking at profitability, once a $50 price on carbon is applied renewable energy emerges as the clear winner.

While many investors lump all their energy investments together, including everything from oil and gas exploration to solar energy, at Entelligent we separate energy investments into non-electric and electric sectors. Think of the non-electric as the sector of the energy market where cars use gasoline and homes use oil and gas for home heating. (The electric segment is energy production from utilities to light our homes and business and power electric cars, typically sourced from some combination of burning coal and use of renewable energy.)

Looking at the supplier cost for non-electric fuel sources produces a surprising result (charts below). Oil remains unattractive regardless of whether it is business as usual or a scenario with a $50 price on carbon. Gas is an alternative, but coal is the clear winner in both scenarios. That suggests that suppliers of coal may still be able to find new markets, even if gasification (pulverized coal with an oxidant to turn it into gas) and then capturing and permanently storing carbon dioxide is required to meet environmental tests. This would perhaps not be viable for home heating applications, but imagine if such specialized systems were built for steel production, cement manufacturing or liquid fuels, for example. It’s an outcome that might surprise policymakers, and could provide a lifeline for coal companies or a path forward for the large, traditional energy companies.

Ultimately, the negotiators seem to have set goals that will change the game significantly in energy markets. It will likely be messy, and wholly political. And there will absolutely be winners and losers.

Thomas H. Stoner Jr. is CEO of Entelligent, a company that tracks alternative energy markets, and the author of, “Small Change, Big Gains: Reflections of an Energy Entrepreneur.”